Texas LP & LLP Formation Attorneys

Setting Up a Limited Partnership or Limited Liability Partnership in Texas

Limited partnership (LP) or Limited Liability Partnership (LLP) allow you and your partners to run a business with limited financial liability beyond your initial investments. In Texas, you must meet a variety of prerequisites to form an LP or LLP, including registration with the Secretary of State, maintaining a registered agent, and obtaining an employer identification number (EIN). It is also a good idea to execute a partnership agreement.

Give yourself a simpler start by working with the LP and LLP lawyers at Hendershot Cowart P.C., serving clients throughout Texas. Make our in-depth familiarity with business law and business litigation your advantage. Why is business litigation experience an advantage? We can help you avoid the disputes and litigation risks that derail many partnerships and disrupt business income.

Ready to start an LP or LLP in Texas? Call (713) 909-7323 or contact us online to get started.

On This Page:

- What Is A Limited Partnership?

- What Is A Limited Liability Partnership?

- What Is The Difference Between An LP And An LLP In Texas?

- Is a Limited Partnership or Limited Liability Partnership Right For You?

- What is the Process of Forming an LP or LLP in Texas?

- How To Dissolve An LP Or LLP In Texas

- Set Up Your LP or LLP – Call To Get Started Today

A limited partnership (LP) is a type of business structure that combines elements of a sole proprietorship and a corporation. It consists of at least one general partner and one or more limited partners.

- General partners: Have unlimited personal liability for the partnership’s debts and obligations. They are actively involved in managing the business.

- Limited partners: Have limited liability, meaning their personal assets are generally protected from the partnership’s debts. They have limited involvement in the management of the business, and are essentially “silent partners”.

Key features of a limited partnership include:

- Pass-through taxation: LPs are pass-through entities, meaning the partnership’s income or losses pass through to the partners’ individual tax returns.

- Flexibility: LPs offer more flexibility than corporations, with fewer formal requirements. It is also easier for a limited partner to exit the business.

- Limited liability for limited partners: This provides a level of protection for limited partners’ personal assets.

A Limited Liability Partnership (LLP) in Texas is a type of business structure that offers limited liability to all partners. This means that a partner’s personal assets are generally protected from the LLP’s debts and obligations, even if another partner’s negligence or misconduct causes financial losses.

Key features of an LLP in Texas:

- Professional liability: LLPs are often used by professionals such as attorneys, accountants, and doctors to protect themselves from personal liability for the professional malpractice of other partners. Partnership assets are not protected from liability, but each partner’s personal assets can be in the event the partnership is successfully sued by a third party for damages.

- Limited liability: All partners have limited liability, regardless of their role in the business.

- Pass-through taxation: LLPs are pass-through entities, meaning the partnership’s income or losses flow through to the partners’ individual tax returns.

- Flexible management: LLPs offer flexibility in terms of management structure, allowing partners to share responsibilities or assign specific roles.

Consult with an attorney to help you understand the laws and regulations in Texas and ensure that your LLP is formed correctly and to mitigate risks of potential partnership disputes.

Learn more about partnership agreements in Texas.

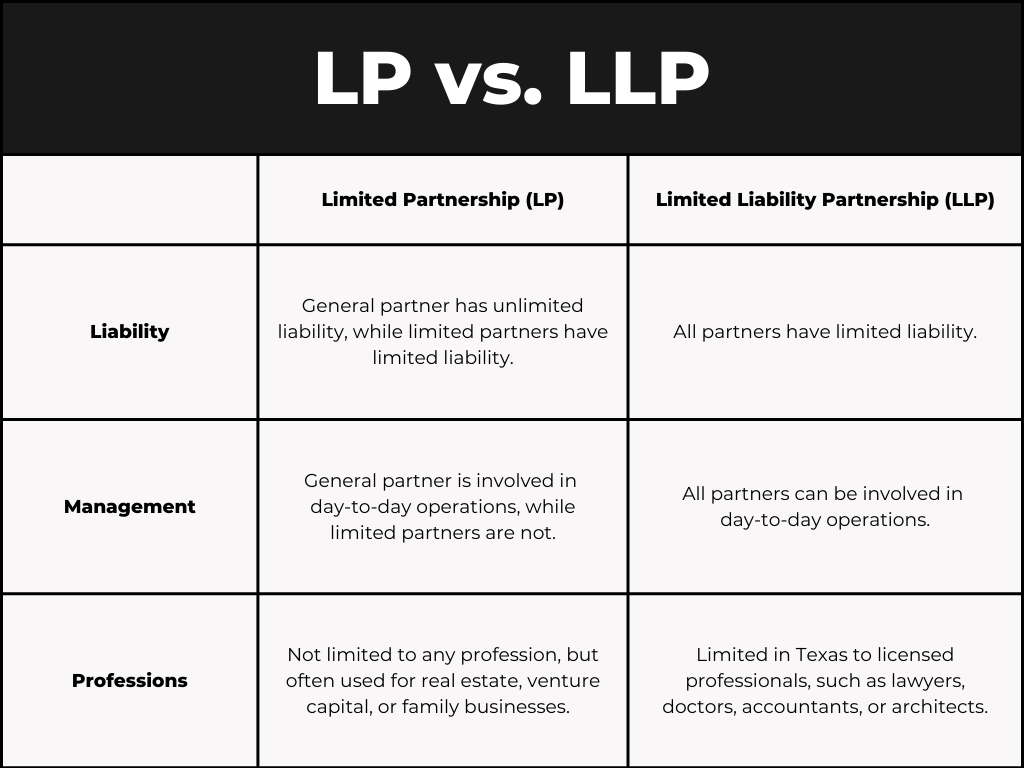

Both limited partnerships (LPs) and limited liability partnerships (LLPs) are business structures that offer limited liability to some or all partners.

However, there are key differences between the two:

- LLPs are generally intended for state-licensed professionals, and all partners have limited personal liability (i.e. personal assets are protected) for the partnership's debts and obligations, including those arising from the negligence or misconduct of other partners.

- LLPs offer limited liability protection for all partners while LPs only limit personal liability for the limited partners. An LP must have a general partner involved in the day-to-day operations; that general partner is not protected from personal liability.

- In an LLP, all partners are permitted to engage in the daily management and important decisions of the business. In an LP, only the general partner will be active in the management of the business, whereas limited partners typically only support the company through financial investments.

Limited partnerships may be best suited for a business that:

- Requires significant capital investment from investors who prefer a passive role;

- Would benefit from a clear distinction between managing and investing partners;

- Is formed for a single project with a limited term; or

- Already has an LLC that can serve as the general partner.

LPs are often used for real estate investments, venture capital firms, and family businesses.

Limited liability partnerships may be best suited for a business that:

- Owned by state-licensed professionals, such as lawyers, doctors, accountants, or architects;

- Want to provide personal liability protection to partners, especially from malpractice; or

- Want to allow partners flexible management roles based on heir interests, experience, or expertise.

The business formation attorneys at Hendershot Cowart P.C. can guide you in selecting the best entity for your needs.

The general steps to form an LP or LLP in Texas include the following:

- Enter into a partnership agreement. A partnership agreement is a legal document, customized for your business, that defines the rights and responsibilities of each partner – covering everything from ownership shares and profit distribution to decision-making and dissolution. While not required by state law, it's a crucial tool for preventing conflicts and ensuring a smooth partnership. Without an operating agreement, your business will be governed by the Texas Business Organizations Code, which may not accurately reflect your intent or the intent of your business partners.

- Choose a name: Texas law requires that the partnership’s name is distinguishable from the name of any existing domestic or foreign filing entity, or DBA, registered to transact business in the state, among other requirements. The name must also include the term "Limited Liability Partnership" or the abbreviation "LLP."Our team can check if the name you want to use is already taken or will be legally valid.

- File your Certificate of Formation: Our team will complete and submit your Certificate of Formation—Limited Partnership or Certificate of Formation—Limited Liability Partnership to the Texas Secretary of State. The filing fee is included in our services.

- Appoint a registered agent. A registered agent in Texas is a designated individual or entity that receives legal documents on behalf of a business. This person or entity acts as a liaison between the business and the state government, ensuring that important legal notices and documents are delivered to the correct party. A registered agent must be on file with the Secretary of State. Hendershot Cowart P.C. serves as the registered agent for many of the entities we help form. This ongoing service is included in our initial entity formation fee, unless otherwise noted.

- Obtain an EIN. An LLP is a separate legal entity from its partners, so it needs a federal employer identification number (EIN) from the IRS, even if it has no employees.

- Report Beneficial Ownership Information (unless exempted) to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury (as required by the Corporate Transparency Act, effective January 1, 2024).

As a business law firm, we routinely assist business owners and entrepreneurs with the formation of entities, including limited partnerships and limited liability partnerships. We can help form your entity with the Texas Secretary of State and craft a partnership agreement tailored to your partnership’s unique needs. With more than 35 years of experience, we are adept at drafting agreements that cover contingencies you may not have considered.

Contact our team at (713) 909-7323 or complete an online inquiry today to ask about pricing and our LP or LLP formation services.

Generally, once the partners have agreed to dissolve the partnership, the LP or LLP must settle its debts, distribute remaining assets, and otherwise wind up the partnership’s business and affairs, as outlined in chapter 11 of the Texas Business Organizations Code (BOC).

Next, the partnership must file a certificate of termination with the Texas Secretary of State. This document indicates the intention to dissolve the entity. The certificate of termination must be accompanied by a certificate of account status from the Texas Comptroller of Public Accounts indicating that all taxes have been paid and that the entity is in good standing for the purpose of termination.

Contact the business formation attorneys at Hendershot Cowart P.C. for assistance with dissolving your LP or LLP in Texas. We routinely form, restructure, and wind down Texas businesses in compliance with state law and Texas Secretary of State requirements.

Ready to start your next business venture with an LP or LLP in Texas? Get our business formation lawyers on your side. We can guide you through the entire process and offer our continued trusted services as your partnership’s registered agent. With our experience and resources, we’re prepared to help you form your business correctly and protect your personal assets from liability where possible.

Call (713) 909-7323 or use an online contact form to talk to our Texas LP and LLP attorneys.

-

We Shoulder the Legal Burden.™And let you get back to business.

-

We Want to Be Your Law Firm for Life.We take a vested interest in our clients' success – from start to finish.

-

We Believe in Prompt, Personal Attention.As a boutique law firm, we unite real experience with personal attention.

-

We Serve Clients Throughout Texas and the Nation.We handle matters from the Red River to the Rio Grande and beyond.

-

In Business Since 1987.Let us put the full force of our 100+ years of combined experience to work for you.

What Our Clients Say

-

“Trey was very responsive to my initial request for a consultation and quick to set up a meeting”

-

“I highly recommend Bryan Tehrani to anyone in need of a skilled, responsive, and genuinely caring attorney. His exceptional service made a significant difference in my experience, and I am incredibly grateful for his support.”

-

“I had a consultation phone call with Ky Jurgensen in early August 2024. He listened to the summary of the probate issue I was facing and then provided me with his thoughts on the best ways in which I could proceed. He clearly understood the issue I was fac”

-

“Ray was very helpful in outlining our legal courses of action that we could take.”

-

“great to work with fast / easy, reliable trustworthy”

-

“I highly recommend anyone in need of legal representation to reach out to the law firm of Hendershot Coward P.C.”

We Are On Your Side

Contact Us To Schedule Your Consultation

-

Federal Court Blocks Corporate Transparency Act: What This Means for Business Owners

Federal Court Blocks Corporate Transparency Act: What This Means for Business Owners -

Selling Your Small Business in Texas: What to Expect and When to Start Planning

Selling Your Small Business in Texas: What to Expect and When to Start Planning -

NLRB to Employers: Make Sure Non-Competes Are Lawful, Or Compensate Employees For Financial Harm

NLRB to Employers: Make Sure Non-Competes Are Lawful, Or Compensate Employees For Financial Harm -

IRS Increasing Audits on Complex Partnerships: What High-Income Taxpayers Need to Know

IRS Increasing Audits on Complex Partnerships: What High-Income Taxpayers Need to Know