The Internal Revenue Service (IRS) accepts most federal tax returns as filed – even for business owners, non-profits, and self-employed professionals. If your return should get flagged for audit, however, don't panic. But do get help. Consult a tax attorney or other professional who can look after your rights as a taxpayer – and help you through the IRS audit process.

Do I Need a Tax Attorney for an IRS Audit?

If you get a letter from the IRS, you should never handle it alone. To handle the audit process well, you will need to understand the Internal Revenue Code or tax code, which includes more than 8,500 pages of fine print. Overall, there are more than one million pages of tax laws in the United States. This is where the help of a tax professional comes in handy.

Tax attorneys have spent years learning these laws, and often have also established relationships with IRS auditors and personnel. Being well prepared and well represented by a tax attorney will increase your odds of successfully navigating an IRS tax audit.

Did you receive a letter from the IRS? You're not alone. Hundreds of thousands of businesses get audited each year. But that doesn't mean you should take the process lightly. Call (713) 528-8793 or contact us online to get help immediately.

How Does an IRS Audit Begin?

Your IRS tax audit begins when you receive an audit letter, or a field agent may show up at your home or business. Do not be fooled by scammers impersonating the IRS that may contact you via text, phone, or email.

How Does the IRS Select Returns for Audits?

The IRS has several methods for selecting a tax return for audit. A few of the more common methods for selecting audit targets are:

- Random selection and computer screening. Computer programs compare your return with statistical “norms” for tax returns in your industry and business size to identify outliers. Self-employed people are often targeted by these screening programs, which are scanning for excessive deductions or under-reported income.

- Tax returns that meet current audit priorities. Some tax returns have characteristics or features that make them more likely to be selected for an audit, such as those outlined in the Treasury Inspector General’s Annual Audit Plan.

- Related examinations. The IRS will audit tax returns related to a return they are already auditing. That relationship may be via a transaction, investment, or partnership.

- Whistleblower reports or referrals. The IRS also accepts reports of suspected tax fraud activity and even offers rewards for reports of taxpayer fraud.

What Is the IRS Audit Process?

The IRS may conduct your audit entirely by mail or schedule an in-person examination. Regardless of how your audit is conducted, work with an expert to guide you through the audit process and help you prepare your response.

Generally, here is what you can expect from the IRS audit process:

- Once your return is selected for an audit, it will be assigned to an IRS examiner who will notify you via letter that your tax return is being audited. The letter will ask for additional information about certain items on your return. You or your representative will need to respond to the IRS in person or by mail.

- Once the IRS has the information it needs, it will review your tax return and share the results of the examination with you. The IRS will either accept your return as filed and send you a letter stating that the examiner proposed no changes to your return (keep this letter for your records) – or explain any proposed changes to you and your authorized representatives. Rest assured, you will have the opportunity to ask about anything that is unclear to you.

- If you agree with a proposed increase in tax, you can sign an agreement form and pay your tax bill, along with any interest and applicable penalties you have accrued.

- If you do not agree with the IRS’ proposed changes, you have the right to appeal.

Appealing an IRS Decision: Beware of Deadlines or Lose Your Right to Appeal

Your right to appeal an IRS decision is protected and defined by the Taxpayer Bill of Rights. If you do not agree with the examiner’s final ruling, you generally have two options:

- You can file a formal written protest to appeal the examiner’s decision via the IRS Appeals Office. You must file a formal written protest within the deadline specified in letter that contains the examiner’s conclusions and offers you the right to appeal, usually within 30 days. Be sure to send the protest within the time limit to preserve your right to appeal. The Appeals Office will hold a conference to review your position and the examiner’s position before communicating its final decision. Taxpayers may choose to represent themselves or retain professional representation. Only attorneys, certified public accountants or enrolled agents are allowed to represent a taxpayer before the IRS Appeals Office.

- If you receive a Notice of Deficiency, or 90-day letter, from the IRS, you have 90 days to challenge the notice by filing a petition with the U.S. Tax Court. This is a final notice from the IRS, sometimes following a series of notices, that you owe taxes or failed to file a tax return.

- Alternatively, you can bypass the IRS appeals process, pay your assessment, and sue for a refund in federal court. You generally have two years to file a refund suit from the date of the compliance action.

Your tax attorney can advise you of the best appeals option for your specific situation.

How Long Does an IRS Audit Take?

According to FAQs from the IRS:

“The length varies depending on the type of audit; the complexity of the issues; the availability of information requested; the availability of both parties for scheduling meetings; and your agreement or disagreement with the findings.”

How Far Back Can the IRS Audit?

The statute of limitations for IRS audits is generally three years. This means the IRS has three years from the date your tax return is filed or due to begin an audit.

The statute of limitations does not apply to fraudulent returns or to substantial errors, however. In these events, the IRS may add additional years, but usually not more than six years.

What Are the Odds of Being Audited?

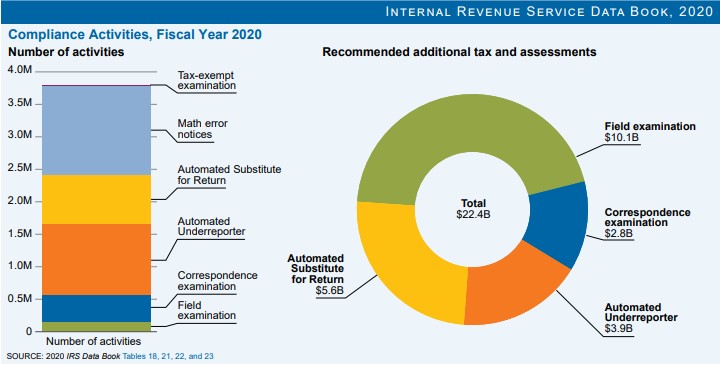

Your odds of being audited increase with your income. According to the 2020 IRS Data Book:

“We have shifted significant audit resources and technology to increase our focus on high-income taxpayers, including those who have failed to file returns and those engaged in certain types of abusive transactions.”

The IRS examined 0.63% of individual returns and 1% of corporation returns from 2010 through 2018. For individuals reporting more than $10 million in positive income, however, the audit rate increased to 9.8%.

What Are the Penalties of a Tax Audit?

If the IRS finds errors in your tax returns, it can assess penalties and fines for every year they find a deficiency, in addition to collecting unpaid taxes. You could be fined up to 75% of what you should have paid. There are also situations in which a civil tax examination can evolve into a criminal tax investigation if possible fraud is detected.

For these reasons, seeking the guidance of a tax attorney or other professional is highly recommended. Hendershot Cowart P.C. has been assisting businesses overcome tax and litigation matters since 1987. Our team values loyalty and relationships, and we want to serve you and your business for life.

Give us a chance to exceed your expectations. Call (713) 528-8793 or contact us online today.

.2204050829550.jpg)